Texas sales tax revenue declines

State agencies, higher ed forced to cut budgets by 5%.

EDDIE GASPAR/The Texas Tribune

Brentwood Social House in Austin is one of many businesses that cut hours of operation and closed its dine-in services during the coronavirus pandemic.

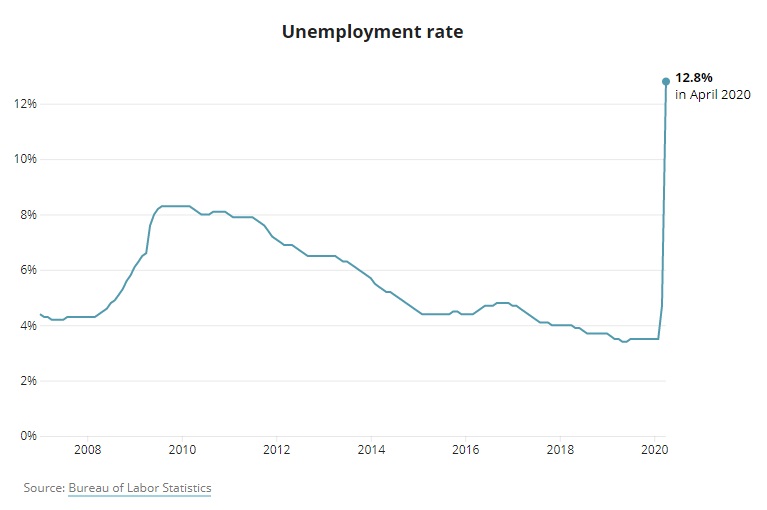

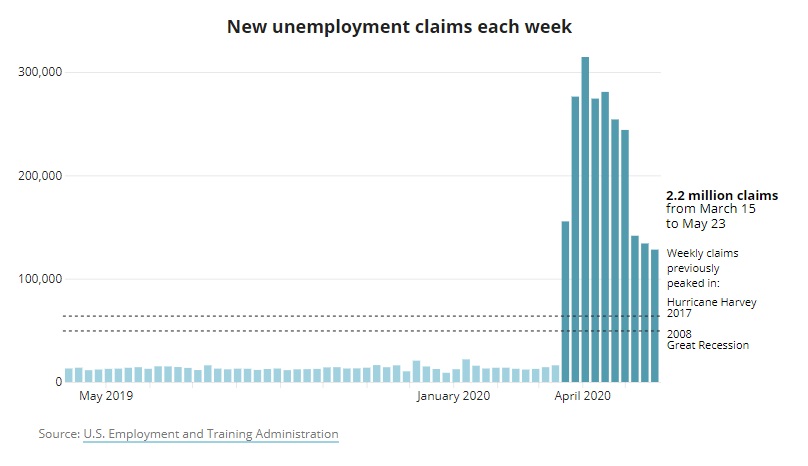

Texas collected about $2.6 billion in state sales tax revenue in May, leading to the steepest year-over-year decline in more than a decade, Comptroller Glenn Hegar announced Monday.

The amount is 13.2% less than the roughly $3 billion the state collected in the same month last year.

A majority of the revenue collected last month was from purchases made in April and reflect the state’s first full-month look at how the novel coronavirus impacted businesses. That is when Texans lived under a statewide stay-at-home order and Gov. Greg Abbott, like leaders across the globe, ordered businesses across several sectors to close to combat the spread of the virus.

“Significant declines in sales tax receipts were evident in all major economic sectors, with the exception of telecommunications services,” Hegar said in a news release. “The steepest decline was in collections from oil and gas mining, as energy companies cut well drilling and completion spending following the crash in oil prices.”

Monday’s announcement is the latest reminder of the economic devastation facing the state — and how recovering from it could last months if not years even as businesses begin reopening their operations, which feed into the sales tax revenue. As social distancing guidelines continue to loosen, Hegar said, the sectors most impacted by the pandemic “should begin to slowly recover.” He said operations resuming at reduced capacity will result in continued reductions in employment, income and activity subject to sales tax for months to come.

Monday’s numbers are also reflective of the lag in data as revenues are collected and then reported by the state. Last month, for example, Hegar announced that the sales tax revenue collections for purchases in March dropped roughly 9% — which at the time was the steepest decline since January 2010.

Other major tax collections were also down in May, Hegar said Monday. Motor fuel taxes, for example, were down 30% from May 2019, marking the steepest drop since 1989. And the hotel occupancy tax was down 86% from May 2019, marking the steepest drop on record in data since 1982.

State leaders are already beginning to offset some of the state’s losses, which will all but certainly be at the forefront of the next regular legislative session in 2021.

Abbott, along with Lt. Gov. Dan Patrick and retiring House Speaker Dennis Bonnen, R-Angleton, instructed certain state agencies and higher education institutions last month to reduce their budgets by 5%. A number of agencies and programs were exempted from the directive, including the Texas Department of State Health Services, the Texas Workforce Commission and funding for school districts.

The agencies and programs excluded from the directive make up a majority of the state’s general revenue funding, according to the Legislative Budget Board, though the three GOP officials made clear that additional budget cuts could become necessary as the fiscal picture continues to come into focus.

Agencies subject to the 5% reductions have until June 15 to submit their plans for cuts to the governor’s office and the Legislative Budget Board.

Some Republicans have pushed for double-digit budget reductions, arguing the economic fallout merits such an action. After Hegar’s last announcement on sales tax revenue in May, the hardline conservative House Freedom Caucus issued a statement calling on state agencies “to immediately identify a minimum of 10% of non-essential expenditures to eliminate,” saying that “the need for strict fiscal responsibility going into the next legislative session” is clear.

At least one state agency has so far exceeded the 5% directive, with Agriculture Commissioner Sid Miller announcing last week he had ordered the Texas Department of Agriculture to cut its budget by 10%.

“This is going to be a tough year for Texas families, and [the] state government needs to tighten its belt along with everyone else,” Miller said in a news release. “While Texas might just be reopening, we will feel the economic impact of this pandemic for a long while.”

It’s unclear how much the initial 5% cuts will offset what’s expected to be a massive shortfall. State Rep. Donna Howard, an Austin Democrat on the budget-writing House Appropriations Committee, said in a statement after the budget cut announcement that while she recognizes the economic fallout, it’s important the Legislature review all available options to address it “with careful and intentional consideration.”

“Texas state agencies were directed to institute similar spending reductions in 2010 to address a $27 billion revenue gap and achieved $1.2 billion in savings for their efforts,” Howard said. “Instructions at that time discouraged non-specific across-the-board reductions and required analyses of reductions’ potential impacts. More specific guidance from current leadership, similar to 2010 instructions, would serve this exercise well.”