Texas House adjourns suddenly after passing property tax, migrant smuggling bills

The Senate is left to either accept the version of the bills the House passed or pass no bills this session

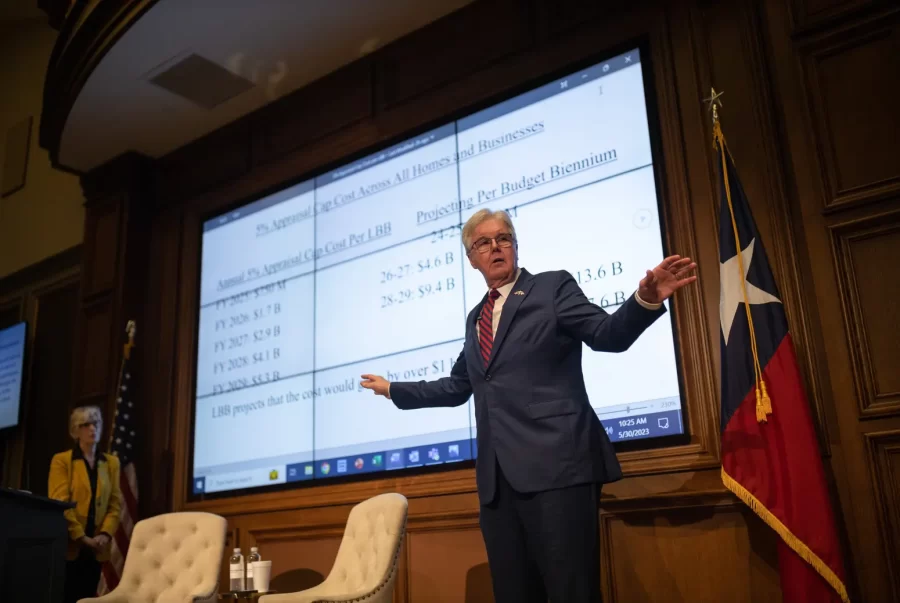

EDDIE GASPAR / The Texas Tribune

Lt. Gov. Dan Patrick recaps the 2023 regular legislative session with Sherry Sylvester, distinguished senior fellow at the Texas Public Policy Foundation, at TPPF headquarters in downtown Austin on May 30, 2023.

After weeks of bickering over whose proposal to cut Texans’ property taxes is better, House Speaker Dade Phelan sent a clear message to Lt. Gov. Dan Patrick, his Senate counterpart, on Tuesday: Take our pitch or leave the special session with nothing.

That message came when the House abruptly adjourned Tuesday after swiftly passing bills on property tax relief and migrant smuggling — the sole items that Gov. Greg Abbott demanded from a special session that began Monday night.

The adjournment means the chamber can’t meet for the rest of the special session, leaving the Senate to accept the version of the bills the House passed or not pass any bill this session.

That bold legislative gambit appeared to be an effort to force the Senate to accept two House bills — one that would increase the minimum sentence for someone convicted of smuggling people and operating a stash house to at least 10 years under state law, and another that would use $12.3 billion in state funds to reduce school property taxes across the state.

For the smuggling bill, that might not be a huge hurdle; a similar version has been filed in the Senate.

But for property taxes, it would require Patrick, who presides over the Senate, to essentially accept what Phelan is pushing without making any changes. And given how Patrick and Phelan have been at odds over property taxes essentially all year, that might be a tough pill to swallow.

Abbott apparently sided with Phelan over Patrick in their monthslong battle over property taxes shortly after the vote on the House bill.

“It provides more cuts to property tax rates than any other proposal at this time,” he said. “It is supported by the most respected tax think tank in the state, as well as more than 30 homeowner, consumer and business groups across the state. I look forward to signing it when it reaches my desk.”

The Republican heads of each legislative chamber have been at odds about how exactly to direct the $12.3 billion they set aside for property tax cuts over the next two years. House Bill 1 and a related resolution, both of which sailed through the chamber Tuesday with no floor debate, would lower school district property tax rates across the board, essentially spreading out the collective $12.3 billion in savings to all property owners, including businesses who own commercial property, investors who own rental properties and people who own their primary residence.

The House version does not include an expansion of the homestead exemption and was backed by Abbott, Phelan and the business community, but was a nonstarter for Patrick and senators, who wanted to concentrate more of the savings on homeowners, who make up more than 60% of adult Texans.

Both leaders want to spend some money on what they call property tax compression, which is essentially sending more state money to school districts in exchange for those districts lowering their tax rates. School district taxes make up the largest portion of taxpayer’s bills.

In one fell swoop Tuesday afternoon, the Senate filed, passed through committee and then unanimously approved Senate Bill 1, a measure that would lower school district property tax rates and expand the homestead exemption, which allows Texans who own their primary residence to subtract a large chunk from the taxable value of their homes. The chamber then recessed until Friday.

“I have been crystal-clear that taxpayers deserve to receive the largest property tax cut in Texas history, and SB 1 delivers on that promise sustainably and responsibly,” Lt. Gov. Dan Patrick wrote in a statement following the vote.

Phelan swiftly rejected SB 1 and a companion resolution when they arrived in the House. Phelan said because the bills would increase the homestead exemption, they fell outside of Abbott’s agenda for a special session. Only Abbott can call a special session and only he can determine which legislation lawmakers take up. Abbott’s agenda item for property tax relief did not include bills increasing the homestead exemption.

The current homestead exemption allows homeowners to deduct $40,000 from their home value before paying school district taxes. During most of the regular legislative session that ended Monday, the Senate proposed raising the school district homestead exemption to $70,000, plus an additional bump for seniors. In the Senate’s latest proposal passed Tuesday, they raised the proposed exemption to $100,000 and kept the additional increase for seniors.

According to the fiscal analysis of the Senate’s new bill, the proposal would direct $12.1 billion to pay for the homestead exemption hike and to help school districts lower their tax rates — an idea known as “tax rate compression.” It’s unclear how an additional $200 million already allocated for new tax cuts would be used.

Abbott’s call for property tax relief said it must be achieved “solely by reducing the school district maximum compressed tax rate.” After determining that the Senate’s legislation went beyond Abbott’s narrow agenda for the special session, Phelan said he would not assign the bills to a House committee for consideration.

The House later Tuesday quickly passed HB 1.

After going most of the year without wading into the property tax-cut debate, Abbott emerged in full force Tuesday. In a Tuesday press release, he touted the support of several business lobbying groups for his proposal to focus on trimming down school districts’ tax rates. Later, a collection of more than 30 business groups — including the Texas Oil & Gas Association, the Texas Association of Business and the Texas Association of Builders — threw their weight behind the proposal in a letter to Abbott, Patrick and Phelan.

“The Governor’s plan would offer immediate and meaningful relief for all property owners in the state,” they wrote.

In the morning, Patrick, who presides over the Senate, used a speech before a conservative think tank to criticize his counterpart in the House and promote his preferred approach to property taxes. Patrick declared that Phelan runs a “dysfunctional chamber.”

“It’s time to call some of these things out, because things have to change,” Patrick told a gathering of the Texas Public Policy Foundation in downtown Austin.

Patrick all but accused Phelan — a real estate broker and partner in a real estate investment firm bearing his name — of trying to benefit himself with the cap proposal.

“In one of those meetings, he said, ‘I own a lot of property, not that it’s about me,’” Patrick said. “Now, anytime anyone says it’s not about me, it’s usually about them. … Now, I’m not saying he was doing that to benefit himself. But I could never figure out why he wanted to do that.”

Disclosure: Texas Association of Builders, Texas Association of Business, Texas Oil & Gas Association and Texas Public Policy Foundation have been financial supporters of The Texas Tribune, a nonprofit, nonpartisan news organization that is funded in part by donations from members, foundations and corporate sponsors. Financial supporters play no role in the Tribune’s journalism. Find a complete list of them here.