International markets mostly higher after Biden, McCarthy reach debt deal

U.S. debt ceiling agreement increases shares worldwide as president, House speaker avoid disaster

EUGENE HOSHIKO / Associated Press

A person looks at an electronic stock board showing Japan’s Nikkei 225 and New York Dow indexes at a securities firm in the rain May 29, 2023, in Tokyo. Asian shares are mostly higher after President Joe Biden and House Speaker Kevin McCarthy reached a final agreement on a deal to raise the U.S. national debt ceiling.

World shares were mostly higher Monday after President Joe Biden and House Speaker Kevin McCarthy reached a final agreement on a deal to raise the U.S. national debt ceiling, though the measure requires approval by Congress.

Paris, Frankfurt, Tokyo, Sydney and Shanghai advanced, while Hong Kong fell. Markets in London and Seoul were closed Monday for holidays, and U.S. markets for Memorial Day.

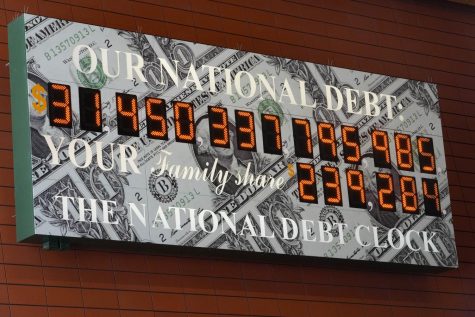

The agreement on the U.S. debt eased what had been a potentially huge threat to markets worldwide. Biden and McCarthy worked over the weekend to try to ensure enough support in Congress to pass the measure before a June 5 deadline and avert a disruptive federal default.

Markets are “reacting cautiously” so far after the debt ceiling agreement, “buoyed, but cautious,” ACY Securities chief economist Clifford Bennett said in a commentary.

“This agreement merely rolls the issue to potentially more politically friendly times post the presidential election in two years,” Bennett said. “Nothing is certain in this regard, and it is possible resolution will be even more difficult then, than it has been on this occasion.”

Germany’s DAX rose 0.2% to 16,010.98, and the CAC40 in Paris edged 0.1% higher. The futures for the Dow Jones Industrial Average and the S&P 500 increased 0.3%.

In Asian trading, Tokyo’s Nikkei 225 index jumped about 2% early on but closed 1% higher at 31,233.54. The S&P/ASX 200 in Sydney jumped 0.9% to 7,217.40. The Shanghai Composite index added 0.3% to 3,221.45.

In Hong Kong, the Hang Seng slipped 1% to 18,551.11.

Taiwan’s benchmark gained 0.8%, while India’s added 0.5%.

Investors have another busy week of U.S. economic updates ahead, including data on consumer confidence and employment.

Technology stocks powered solid gains for Wall Street on Friday. Marvell Technology surged a record-setting 32.4% after the chipmaker said it expects AI revenue in fiscal 2024 to at least double from the prior year. On Thursday, fellow chipmaker Nvidia soared when it forecast upcoming sales related to artificial intelligence.

The S&P 500 rose 1.3%, and the Dow industrials gained 1%. The tech-heavy Nasdaq notched the biggest gains, surging 2.2%. The index rose 2.5% for the week.

The revolutionary AI field has become a hot issue. Critics warn that it is a potential bubble, but supporters say it could be the latest revolution to reshape the global economy. The nation’s financial watchdog, the Consumer Finance Protection Bureau, said it’s working to ensure that companies follow the law when they’re using AI.

Wall Street and the broader economy already had mounting concerns before the threat of the U.S. defaulting on its debt became sharply highlighted on the list.

A key measure of inflation that is closely watched by the Federal Reserve ticked higher than economists expected in April.

The persistent pressure from inflation complicates the Fed’s fight against high prices. The central bank has been aggressively raising interest rates since 2022 but recently signaled it will likely forgo a rate hike when it meets in mid-June. The latest government report on inflation is raising concerns about the Fed’s next move.

The latest inflation data also highlighted the continued resilience of consumer spending, which has been a key guard, along with the strong jobs market, against a recession. The economy grew at a sluggish 1.3% annual rate from January through March and it is projected to accelerate to a 2% pace in the current April-June quarter.

The impact from inflation and worries about a recession on the horizon have been hitting corporate profits and forecasts. The latest round of company earnings is nearing a close with the profits for companies in the S&P 500 contracting about 2%.

In other trading Monday, U.S. benchmark crude oil added 14 cents to $72.81 per barrel in electronic trading on the New York Mercantile Exchange. It picked up 84 cents to $72.67 per barrel on Friday.

Brent crude, the standard for international trading, advanced 5 cents to $77.03 per barrel.

The dollar slipped to 140.26 Japanese yen from 140.59 yen. The euro fell to $1.0717 from $1.0724.